WASHINGTON – Daniel Adeleye wasn’t planning on taking a gap year after his May 16 graduation from Mustang High School. But a botched FAFSA rollout is forcing him and thousands of other 2024 Oklahoma high school graduates to rethink their college plans.

Millions of high school students rely on FAFSA, a federal government acronym that stands for Free Application for Federal Student Aid, to help determine how much financial aid they might receive as they consider which college or university to attend.

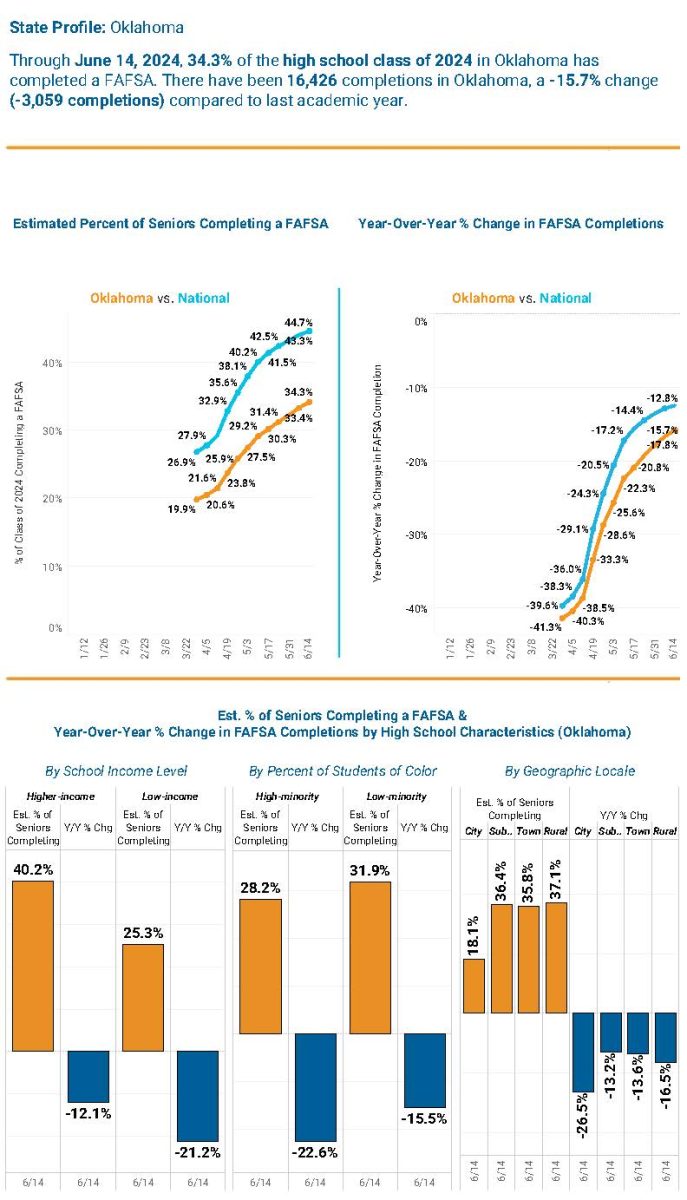

According to the National College Attainment Network, Oklahoma is ranked 46th in the nation due to the low number of 2024 high school graduate FAFSA completions.

“I was applying to the University of Oklahoma and Oklahoma State University and colleges outside of Oklahoma like the Massachusetts Institute of Technology, Texas A&M and Howard University,” said Adeleye, who graduated with a 4.0 GPA.

Now he will instead continue studying aviation maintenance at Canadian Valley Technology Center in El Reno.

Adeleye aimed for aerospace programs out of state, but the former vice president of the Mustang Technology Student Association said a major reason he is not yet attending college is that he did not receive sufficient scholarships.

“I didn’t meet the financial requirements for Oklahoma’s Promise, and didn’t receive any scholarships from my high school. Staying in state is the least strain on me and my family financially,” said Adeleye, who was unable to complete all the forms required by FAFSA due to the confusion of the new layout.

In Oklahoma, 34.3% of the class of 2024 graduates completed the FAFSA. Compared to the 2023 academic year, completion rates dropped in Oklahoma by 15.7%, or more than 3,000 applications.

The Osage Nation Education Department (ONED) hosted a FAFSA night for Johnson-O’Malley seniors on Jan. 10. The Johnson-O’Malley Program is a federal program designed to help eligible American Indian and Alaskan Native Students from age 3 through grades 12.

Tribal Education Advocate for ONED, Sam Lockett, attended the FAFSA Night to help the seniors fill out the labyrinthine form.

As a result of the FAFSA Simplification Act, which was passed by Congress in 2021, the application was changed. The revamp was supposed to downsize the form but instead made it more complicated due to repeated delays, technical glitches and new requirements. According to the Federal Student Aid website, the newest editions of the form had questions about race, ethnicity and sexuality that have no effect on one’s financial eligibility.

“When FAFSA did their rollout, (the website) was periodically down, and that night we had a few students able to complete (their FAFSA) and a few students in purgatory,” Lockett said. “About 80% of our students in attendance were not able to completely finish their FAFSA that night.”

FAFSA is the starting point for students to be reviewed for eligibility for federal, state and institutional need-based aid. The application allows for consideration of aid options that might include grants, direct student loans and the option for parent loans to help cover any funding gaps.

High minority and low-income completion rates have plunged more than 20 percent this year in the Sooner state.

“I (was) in schools for the next few months, so I helped fill out the FAFSA for Hominy, Woodland and Shidler High School students,” Lockett said.

Examples like the FAFSA Night raise the question of whether the decline in completion rates is due to the FAFSA rollout itself or the financial hole dug by attending a university.

“I didn’t get any money because of a mess-up on our end and the FAFSA website wouldn’t let us correct it,” said 2024 Pawhuska High School graduate Liliana Guillen Hudgins. “It took forever for them to review, so I just gave up.”

Pawhuska High School’s class of 2024 completion rate for FAFSA stands at 56.5%, with a 8.3% year-to-year increase.

Guillen, 18, a citizen of the Muscogee (Creek) Nation, attended the Dance Maker Academy in Pawhuska and studied ballet while taking on part-time jobs to stay as financially independent as possible.

Guillen said she feared that attending college would be a financial burden to her family. She said she wanted to support herself financially before committing to a college where she would need to juggle more than she could handle.

“I didn’t want to take out student loans because I see my family working to pay them off to this day,” Guillen said.

Guillen will not be attending a university in the fall, but recently received a cosmetology license from Tri-County Tech in Bartlesville with plans of starting her own business and attending online college in the future.

With only weeks remaining until the fall semester begins, recent high school graduates are questioning whether to attend college due to the chaotic rollout of the federal student financial aid application as well as increasing tuition rates.

According to the National College Attainment Network’s FAFSA Tracker, students at Ponca City High School, Lawton High School, and Booker T. Washington (Tulsa) High School have reportedly dropped over 30% in FAFSA completion rates, while Tonkawa High School, Boswell High School, and Red Creek High School FAFSA completion rates dropped over 60%.

First-generation student, Carlee Fort, is a junior at the University of Oklahoma majoring in management information systems who struggled with FAFSA.

“As a first gen with no parents, I have to go a different route then everyone else when it comes to FAFSA,” Fort said. “It was very nerve-wracking having to wait to fill it out even longer because normally I have to get three letters written to confirm my situation. I was on an even more stressful timeline, especially with the new way the form is set up.”

Courtney Henderson, executive director of Financial Aid Services at the University of Oklahoma, said “the reduced FAFSA completion rate for Oklahoma is a concern and we encourage students to complete the FAFSA as soon as they can. The National FAFSA Tracker and National College Attainment Network indicate this is an issue across the country. There is still plenty of time for students to apply for fall 2024 and spring 2025 aid. Those applications will continue to be received throughout the upcoming year.”

Despite the flighty new form, Henderson encourages all students, regardless of their financial situations, to apply for aid through the FAFSA and CASH when it opens in October. The Centralized Academic Scholarship Hub (CASH) is an online location where current and continuing OU students can apply for scholarships.

“The FAFSA and CASH resources help students receive additional assistance. I also think all students should get to know someone in the Student Financial Center. Student service experts and MoneyCoachs are here to help students find financial solutions. We need to know the specific issues students are facing to offer them individualized guidance,” Henderson said.

Federal Student Aid Chief Operating Officer Richard Corday, who is receiving most of the backlash from the FAFSA controversy, announced on April 26 he would be stepping down at the end of June.

Because of the downturn in completed forms, the Department of Education will be investing $50 million to help increase the number of FAFSA applications completed. The investment is to provide extended support for students who didn’t already complete the application.

“The FAFSA application process has been redesigned for the 2024-25 aid year through the FAFSA Simplification Act. Until a FAFSA is signed by all contributors, submitted, and processed by the Department of Education…we are unable to review and troubleshoot any issues that students and their families may run into within the application,” Henderson said, adding it is best students deal directly with Studentaid.gov..

OU has never had a deadline for FAFSA. Students can file for FAFSA anytime throughout the academic year and receive eligibility as long as it is received before the end of the term they want to be assisted. Once the FAFSA has been submitted and processed, schools can review the data and assist with additional questions.

Anika Carr, director of Financial Services at Southwestern Oklahoma State University, said “It’s concerning to see a drop in FAFSA completion rates. Access to financial aid is crucial for many students to pursue higher education without excessive financial burden.”

SWOSU markets itself as one of the most affordable colleges in Oklahoma, with the average annual in-state undergraduate cost at $7,358 before aid. The public university located in Weatherford and Sayre is also nationally recognized for its online programs.

SWOSU’s Student Financial Services helps students steer their way through financial challenges and find scholarship opportunities, Carr said.

“We recognize that every student faces unique challenges in the application process for financial aid,” said Carr. “I would encourage them on their path to complete the application and let them know that help is just a phone call or an email away.”

Gaylord News is a reporting project of the University of Oklahoma Gaylord College of Journalism and Mass Communications.