WASHINGTON — A long-awaited cannabis banking bill is making its way to the Senate floor after years of being held up in Congress.

But as the government recovers from a weeks-long speaker’s race and barrels toward another potential government shutdown, many in the cannabis industry say they are hesitant to raise their hopes about the bill moving forward.

“I’m cautiously optimistic,” said Lawrence Cagigal, CEO of The Cagigal Group, which provides financial services and support for the cannabis industry. “But either way, getting it this far means a lot to the industry.”

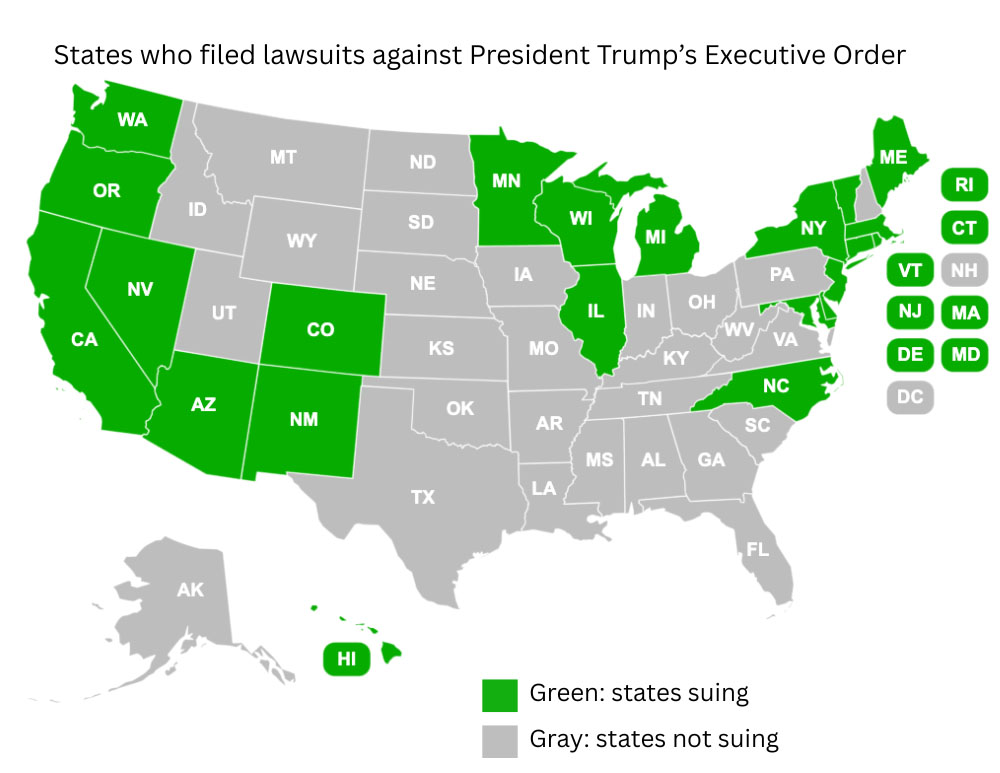

The Secure and Fair Enforcement Regulation (SAFER) Banking Act, SB. 2860, was introduced Sept. 20 and approved by the Senate Committee on Banking, Housing and Urban Affairs with amendments Sept. 27. If passed, the bill would allow banks to work with legally operating cannabis businesses without facing penalties.

Seven versions of this legislation have passed through the House since 2019. However, this move marked the first time Senate members voted in favor of the measure, with a 14-9 vote to advance the amended bill to the floor for consideration by the full chamber.

“(It’s) such a breath of fresh air, seeing the progress we’re making on this SAFER Banking Act,” said Robert Cox, owner of Friendly Market Dispensary on Porter in Norman, Oklahoma.

“You kind of see the speck of light in the darkness sometimes, and this is definitely one of them.”

‘They don’t have another option’

Under current federal law, providing financial services to cannabis businesses is strictly regulated, leading many banks to turn them away or charge exorbitant fees to offset the potential risks, such as federal regulators taking away the bank’s insurance or downgrading its services. Additionally, many banks don’t have the resources needed for the enhanced due diligence required to vet their cannabis clientele.

“(It) throws in quite a wrench for banks that are thinking about (and) are hesitant to work with these businesses,” said Davis Mitchell, Senior Analyst for special programs for Regent Bank, which was one of the first financial institutions to offer services to the cannabis industry.

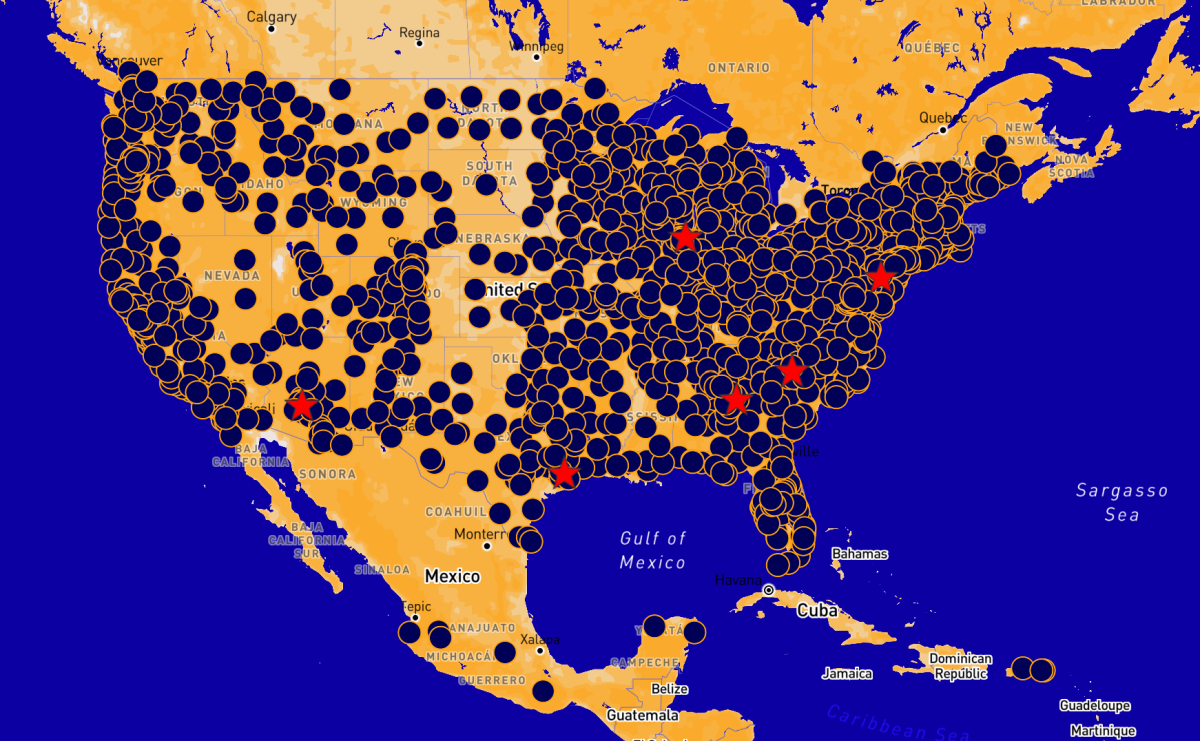

Mitchell added that in Oklahoma, which has over 10,000 licensed medical marijuana businesses, including more than 6,000 grow operations and nearly 3,000 dispensaries, the competition is so intense that many businesses can’t afford the fees it takes to put their money in a bank, forcing them into cash-only operations.

“Because of that, it makes the whole ecosystem reliant on cash,” Mitchell said. “(Cannabis businesses) don’t have another option right now.”

If passed, Mitchell said the SAFER Banking Act would provide protections to banks working with cannabis businesses, which would likely encourage more banks to do so.

“(Banks are) really in need of newer guidance. We need more access for our cannabis businesses. And we think that SAFER is going to provide that,” Mitchell said.

While the bipartisan bill has received widespread support from politicians and businesses alike, it is not without opposition.

In a letter signed by Senators James Lankford (R, OK), Pete Ricketts (R, NE), John Cornyn (R, TX) and Ted Budd (R, N.C.), the conservative Republicans said they would oppose the bill if it advances to the floor, claiming the legislation would set a “dangerous legal precedent,” would help facilitate money laundering for drug cartels and allow the industry to increase product potency and bring in new users.

Senator Markwayne Mullin’s (R, OK) office declined to comment before the measure reaches the Senate floor.

The Oklahoma City Police Department declined to comment on how the SAFER Banking Act might affect money laundering.

‘Step in the right direction’

For Cox, Friendly Market Dispensary’s owner, finding a bank that would serve him has been a long and strenuous process.

Since he began selling marijuana in 2019, Cox said he has approached several banks for both business and personal financial needs. Again and again, he was turned away.

“The very first bank we got said ‘Sorry, Robert, we’d love to keep you but it’s just too much for us.’ So we go from that bank to another bank and kind of ran into that a couple of times,” Cox said.

Eventually a local bank accepted Cox as a customer, but the dispensary owner is required to pay additional fees in order to access the financial services.

Still, those in the cannabis industry say more needs to happen for them to be on the same playing field as other businesses — including rescheduling the drug from the Drug Enforcement Agency’s Schedule I to Schedule III.

Under Section 280E of the IRS tax code, which applies to controlled substances on Schedules I and II of the Controlled Substances Act, cannabis businesses are prohibited from taking traditional business deductions because the plant is listed as a Schedule I drug, along with heroin and lysergic acid diethylamide (LSD). Moving cannabis to Schedule III would mean 280E would no longer apply to cannabis businesses.

“It creates an unfair tax burden for these cannabis businesses that…(are) going above and beyond to operate legally,” Mitchell said.

SAFER wouldn’t change that, Mitchell added. It will take rescheduling the drug in order for cannabis businesses to be able to write off those business expenses.

On Aug. 30, the U.S. Department of Health and Human Services, as part of a review directed by President Joe Biden, recommended that cannabis be moved from Schedule I to Schedule III. However, the U.S. Drug Enforcement Agency has yet to adopt the recommendation.

“The political side is catching up to the real world,” Cagigal said, noting that there’s currently a disconnect between federal and state laws surrounding cannabis. “It is a great step in the right direction.”

‘Not going to hold my breath’

However, as the government heads toward another shutdown when current funding expires Nov. 17, some in the cannabis industry think it will be a long time until the bill sees additional movement.

“I’m just a little more optimistic, but the reality is we get our hearts broken every time, pretty much. So I’m not going to hang my hat on any meaningful movement until it (has) reached the point where it’s more likely than not,” said Blake Cantrell, CEO of The Peak Dispensary in Oklahoma.

“We’re as close as we’ve ever been, but I’m not going to hold my breath for it.”

Gaylord News is a reporting project of the University of Oklahoma Gaylord College of Journalism and Mass Communication. For more stories by Gaylord News go to GaylordNews.net.